I saw this graph recently and thought I would share it.

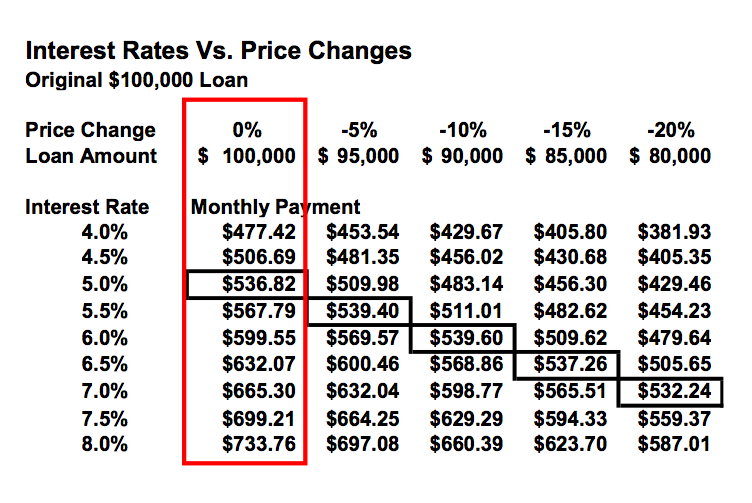

Nothing new here, people have been talking about this concept for years – waiting for prices to drop more vs. the risk of higher interest rates. Well, here it is again, based on a $100,000 loan.

There are two keys questions buyers need to consider right now –

1. How much more are prices going to drop in the market they are looking to buy in?

Few experts believe that prices are going to go down another 20%. It could happen, especially in the upper end price range of each market, but it is not expected for the remainder of the market. Most agree that we are pretty close, within 5-10%, of the pricing bottom.

2. What will happen to interest rates?

Again, no one knows for sure, but most expect that rates will rise above the current 30-year rate of 5%.

So, if prices come down another 10% over the next year, and interest rates go up 1%, there really is no savings on the monthly payment. Sure, you may save 10% on the purchase price, but is that worth the wait and risk?

Each buyer must answer that question for themselves.

There are some added benefits of owning a property earlier than later – tax write offs, benefit of use, potential income, etc. Plus, if you hold onto the property for 10 years or so, 10% really won’t make a huge difference in the selling price.

Just some food for thought.

I’d like to see the graph reconfigured to show difference in overall home price for each point drop versus total interest paid over the life of the loan for each half-point increase. I think that would be more meaningful than looking at monthly payments.

Thanks Dee. I’d have to think about that one for a while. I didn’t put this graph together but I may be able to put something together that fits what you’ve described.

I did figure out a single case for a friend of mine who had this question. Here’s his example: Financing $300,000 for 30 yrs at 5.5% now, or financing the same house, where the price has theoretically dropped to $260,000, at 6.5%. In the first case the total amount of interest paid is $313,212.12, with a monthly payment of $1703.37. In the second it’s $331,615.67, monthly is $1643.38. I told my friend that for these numbers, I’d consider this pretty much a wash in terms of overall interest & that he wasn’t going to save a huge amount by jumping on the lower interest rate: In this case, he can bide his time a little. Financing $260,000 at 7.5%, though, things are starting to get skootchy: Overall interest is now $394,464.78 & monthly payment $1817.96. In that case, the price drop would not be worth the savings he could get by going with the lower interest rate, IMHO.

I did tell him, though, that one advantage to waiting for prices to drop, even if the interest rates are a little higher, would be that something previously out of his price range might fall into it & possibly he’d get more house that way. He’d just have to keep an eye on the interest rates. Finally, I told him that if he is looking at his perfectamundo, all-time dream house today, he should not let the numbers & a few grand keep him from living in it–he’d just have to decide what his breaking point was in terms of second-guessing himself after the fact; i.e., 5 years from now will you be able to say that you are happy in the house even though you paid more for it? Or are you going to kick yourself until the day you die & wish you had acted when the interest rates were low?

You can’t graph that kind of thing, unfortunately.

Dee, those are great points and insight. I appreciate you sharing that. Makes it a whole lot easier to understand for myself and others I’m sure.