Home sales in Big Bear remained relatively stable in April 2010 while prices dropped pretty significantly. Big Bear Home Sales Home sales in April were up 3% when compared to the March sales (76 v. 74). Year over year, sales are up 21% from April 2009, more good news for the market. Compared to April 2008, sales were up 52%! 32, or 42%, of the 76 home sales in Big Bear were bank owned, about 5% less than last month. 40-50% per month is about the average we've been seeing for a while now. 11 of the sales, or … [Read more...]

2 Things That Do Not Affect Big Bear Real Estate Values

Click here if you cannot see the embedded video. 1. What the seller paid for it. 2. What the seller needs to get out of it. The market value is what it is, and has no relation to what the seller got it for, or what they owe or need to get out of it. While it may determine whether or not a buyer wants to buy it, or whether or not a seller wants to sell, it does not change the current market value. Your thoughts? … [Read more...]

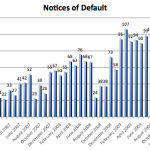

Big Bear Foreclosure Numbers – March 2010

Foreclosure filings in Big Bear rose 12% in March 2010 when compared to February. Year over year however, foreclosure filings were down 3% from the March 2009 numbers, the third month in a row that foreclosure filings were down year over year. Keep in mind, foreclosure filings are made up of three parts - Notices of Default (NOD), a recorded document that starts the foreclosure process, which is normally filed after homeowners fall behind in their payments. Notices of Sale (NOS), a recorded document that is … [Read more...]

Got Patience?

The lack of pateince is the hero of our demise. - unknown author … [Read more...]

Daxton learns to crawl!

My son finally figuring this crawling thing out. He started off dragging his head around on the ground. This looks a little more the Army crawl but it works. Man, I love this kid! IMG_0553.MOV Watch on Posterous … [Read more...]