Foreclosure filings in Big Bear dropped 6% in April 2010 when compared to March. Year over year, foreclosure filings were down 4% from the April 2009 numbers, the fourth month in a row that foreclosure filings were down year over year.

Keep in mind, foreclosure filings are made up of three parts – Notices of Default (NOD), a recorded document that starts the foreclosure process, which is normally filed after homeowners fall behind in their payments. Notices of Sale (NOS), a recorded document that is filed about 3 months after the NOD, which sets the date for the Trustee Sale. Trustee Sales, typically held around 25 days after the NOS is filed, made up of properties that go back to the bank or sold to third parties, generally on the court house steps.

In April, Notices of Default & Trustee Sales went back to the bank increased just a bit, while Notices of Sale dropped considerably.

Here’s how the foreclosure numbers broke down for April 2010.

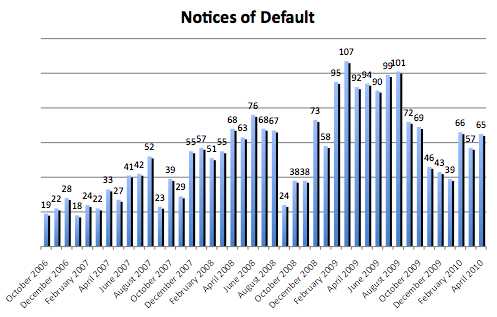

Notices of Default (NOD) – 65 total, up 14% from March but down 29% from April 2009.

Not as high as a year ago, which was some of the highest numbers we’ve seen for Defaults, but sill elevated. In my opinion, not until the Default numbers get consistently below 20 per month, will we start to see prices get better in the Big Bear real estate market. Since this is the start of the foreclosure process, and the majority is these will end up on the market as an REO or bank owned, it is a signal of things to come 6-12 months down the road.

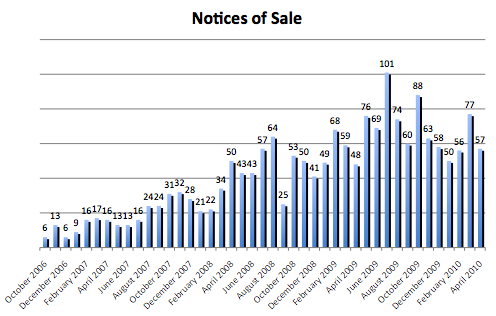

Notices of Sale (NOS) – 57 total, down 26% from March but up 19% from April 2009.

Monthly numbers for NOS are still all over the place, but like the Defaults, April was elevated.

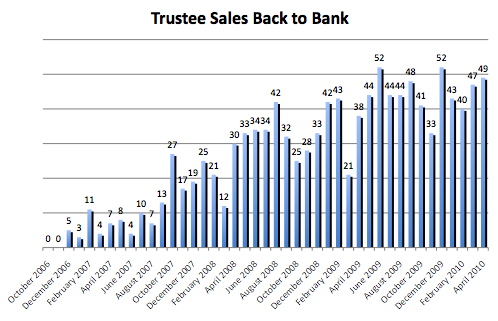

Trustee Sales back to bank – 49 total, up 4% from March and up 29% from April 2009.

This number is at the upper end of the monthly average, and only 3 below the all time monthly high of 52. Many of these 49 are already on the market or getting close to being put up for sale.

Want to see what actually happens at Trustee Sales? Check out the video below.

Foreclosure Inventories In Big Bear (aka the Foreclosure Pipeline)

| Feb. 2010 | Mar. 2010 | April 2010 | |

| Preforeclosure (Notice of Default) | 166 | 187 | 189 |

|---|---|---|---|

| Auction (Notice of Sale) | 192 | 186 | 168 |

| Bank Owned | 175 | 179 | 167 |

There still remains a large amount of Big Bear properties in the foreclosure pipeline – 189 properties have an NOD filed against it, 168 a Notice of Sale, and 167 are currently owned by the Bank or Lender. Of those 167 that are bank owned, some are already on the market for sale, some are not, and a small amount have already re-sold to new owners. All in all, month over month, the foreclosure inventory in Big Bear is down 5% from last month.

Why are these numbers important? In my opinion, they are the most important stat to keep track of as they offer a glimpse into the future of any market. Everyone knows that foreclosures bring prices down in neighborhoods. So, the more foreclosures in an area, the more the downward push on pricing. And, if we want the market/prices to get better, we need to get all of these properties through the foreclosure pipeline first. But, as I stated earlier, the more Defaults that happen, the more that gets added to the pipeline.

We are still in for a long, bumpy ride..

Speak Your Mind