Foreclosure numbers in Big Bear slowed a bit in August though they still remain near record highs.

The foreclosure filings in August 2009 (219) were down 10% from July 2009 (244), but were still up 27% from August 2008 (173).

Foreclosure filings are made up of Notices of Default, a recorded document that starts the foreclosure process, Notices of Sale, a recorded document that sets the date for the Trustee Sale, and lastly, Trustee Sales, properties that go back to the bank or sold to third parties.

Here’s how the foreclosure numbers broke down for August 2009.

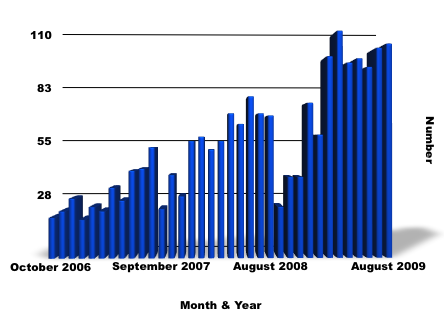

Notices of Default (NOD) – 101 total, up 2% from July and up 37% from August 2008.

The NOD have been hovering around 100 for the last 7 months, which means every month nearly 100 property owners in Big Bear are starting down the foreclosure road. Sad, but very true.

Until we see this number start to shrink, we will continue to see bank owned properties hitting the market in Big Bear.

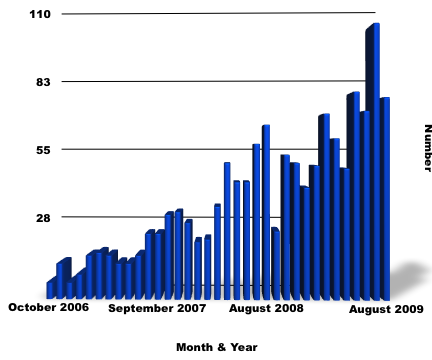

Notices of Sale (NOS) – 74 total, down 27% from July but up 15% from August 2008.

As you can see from the graph above, this was a pretty sharp drop from the 101 NOS we saw last month, the highest we have ever seen I might add. The August numbers are more in line with the numbers from May and June, and still quite high historically speaking.

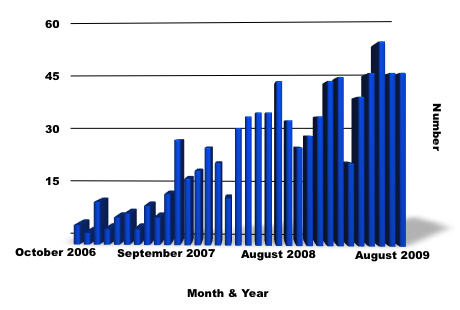

Trustee Sales – 44 total, that same number from July and up only 5% from August 2008.

This number remains on the higher end of the scale and is consistent for what we’ve seen the past 6 months for properties in Big Bear that are going back to the bank.

What do all these numbers mean? In my opinion, more bank owned properties on the market, and in turn, more competition with organic sellers, and prices continuing to stay depressed. Overall, still some good opportunities for Big Bear home buyers.

Related Articles

Big Bear Foreclosure Numbers – July 2009

Big Bear Foreclosure Numbers – June 2009

Big Bear Foreclosure Numbers – May 2009

Big Bear Foreclosure Numbers – April 2009

Big Bear Foreclosure Numbers – March 2009

Big Bear Foreclosure Numbers – February 2009

I am a simple critter, to sum up, it looks like the trends on new foreclosures are heading toward fewer?

Thanks,

Keahi