Foreclosure filings in Big Bear were down 14% in January 2010 when compared to December 2009. Year over year, foreclosure filings were down 7% from the January 2009 numbers. This is kinda big news as it is the first time in more than a year that I can recall the overall foreclosure filings down year over year.

A sign of things getting better? I don’t think so.

Keep in mind, foreclosure filings are made up of three parts – Notices of Default (NOD), a recorded document that starts the foreclosure process, which is normally filed after homeowners fall behind in their payments. Notices of Sale (NOS), a recorded document which is typically filed about 3 months after the NOD, and sets the date for the Trustee Sale. Trustee Sales, typically held 25 days after the NOS is filed, made up of properties that go back to the bank or sold to third parties, generally on the court house steps.

One thing that continues to stand out – many lenders are not foreclosing as quickly as they could be. This is not necessarily a bad thing as it give people some time to try a short sale, or loan modification. But, it is hard to track and forecast the amount of properties in distress as they do not show up on the radar until they enter the foreclosure process i.e. a notice of default is filed. These properties are delinquent and behind on payments, yet the lenders are not pursuing it. Also, it is not uncommon for the lender to delay the trustee sale date numerous times, further delaying the process and adding uncertainty.

A good example of this can be found in the most recent Foreclosure Radar monthly report. In August of 2008, the average amount of time if took from the date of the NOD to the Trustee Sale was 146 days for the state of CA. Compare that to 229 days average for January 2010. That’s 124 days, or 4 months in delays.

So, just looking at the numbers below will not give you the whole story on what is going on with the foreclosure market in Big Bear.

If anyone thinks this market is going to turn around quickly, you are mistaken. This is going to be a long, drawn out process.

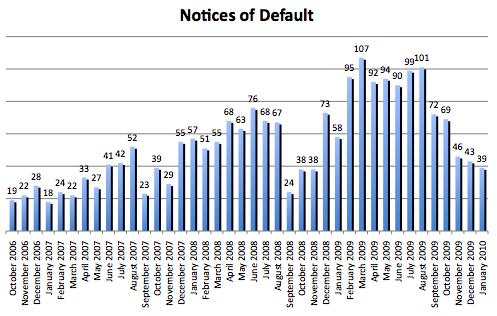

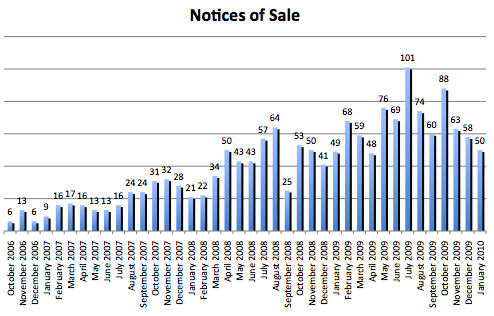

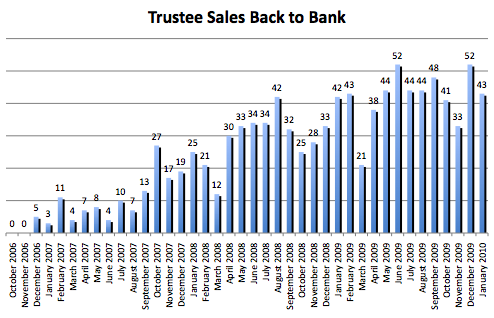

Notices of default dropped to the lowest monthly number since November 2008, while Notices of sale dropped to the lowest levels since April 2009. Trustee sales back to the bank remained near their monthly average.

Here’s how the foreclosure numbers broke down for January 2010.

Notices of Default (NOD) – 39 total, down 9% from December and down 33% from January 2009.

Notices of Sale (NOS) – 50 total, down 14% from December but up 2% from January 2009.

Trustee Sales (properties that went back to bank) – 43 total, down 17% from December but up 2% from January 2009.

Want to see what actually happens at Trustee Sales? Check out the video below.

What can we expect in the future?

There are still plenty of Big Bear properties in the foreclosure pipeline – 158 properties with a NOD filed against them, and 207 properties with a NOS, that’s 365 total. This does not include properties already foreclosed on by the bank that are not on the market, I’d guess around 30 properties there. Nor does it include all of the properties that are delinquent yet not in the foreclosure pipeline.

Again, we are a long way from seeing the end of foreclosures in the market.

Speak Your Mind