Foreclosure filings in Big Bear were up 10% in October 2009 when compared to the previous month. Year over year, foreclosure filings were up 70% from the October 2008 numbers.

New notices of sale shot up in October, showing that banks are still moving forward on foreclosures, while new notices of default and Trustee sales remained relatively the same.

Keep in mind, foreclosure filings are made up of three parts – Notices of Default (NOD), a recorded document that starts the foreclosure process, which is filed after homeowners fall behind in their payments. Notices of Sale (NOS), a recorded document which is typically filed about 3 months after the NOD, and sets the date for the Trustee Sale. Trustee Sales, properties that go back to the bank or sold to third parties, generally on the court house steps.

Here’s how the foreclosure numbers broke down for October 2009.

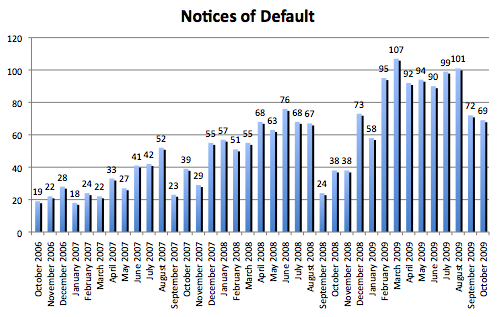

Notices of Default (NOD) – 69 total, down 4% from September but up 81% from October 2008.

This was another slow month for defaults when compared to January thru August, but it is still high when compared to the Oct. 2006 thru November 2008 default numbers. These numbers will need to slow down a lot more for things to get better in the real estate world.

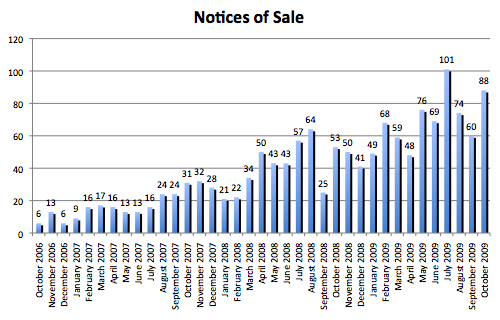

Notices of Sale (NOS) – 88 total, up 47% from September and up 66% from October 2008.

After two straight months of a drop in the notices of sale, they jumped back up in October. This just goes to shown that it is hard to predict what the banks are going to do. Given that these notices set a sale date on the property, banks appear to be getting more aggressive with these assets. However, it is important to note that many sale dates are later postponed by the banks, thus adding to the delays of these properties being taken back and hitting the market.

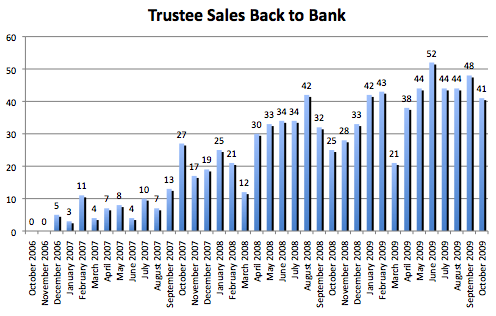

Trustee Sales (properties that went back to bank) – 41 total, down 17% from September but up 64% from October 2008.

This is pretty consistent for what we’ve been seeing the whole year, around 40 properties per month in Big Bear are becoming bank owned. These properties will inevitably hit the market for sale over the next 1-2 months, depending upon occupancy and personal property.

What can we expect in the future?

As of today’s date, there are currently 492 properties in Big Bear that are in foreclosure. This is made up of 268 properties in pre-foreclosure (a notice of default has been filed), and 224 properties set up for auction/trustee sale (a notice of sale has been filed). This DOES NOT include the many properties in Big Bear that are in default, and the banks have not filed the notice yet. My guess is there are many out there that we do not know about.

The main question I would ask is how many of these 492 will be coming on the market as bank owned? My best answer – at least 80% of them, or 393. Given that we are seeing an average this year of 41 going back to the bank every month, that means about 9.5 more months of bank owned properties hitting the market, assuming no more go into default. And we know that is just not realistic, there will be more defaults.

Based on these numbers, I believe the real estate market in Big Bear is still in for a long, slow recovery. Once we see the default faucet turn off, and the tub of bank owned properties gets drained, then I think it will be safe to say the market has turned around.

Speak Your Mind