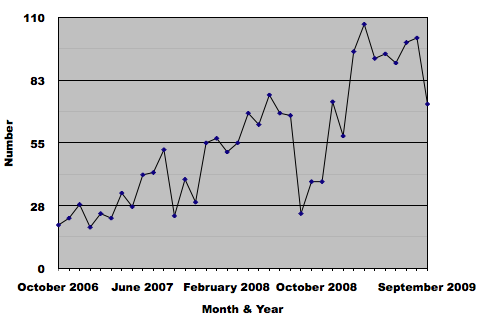

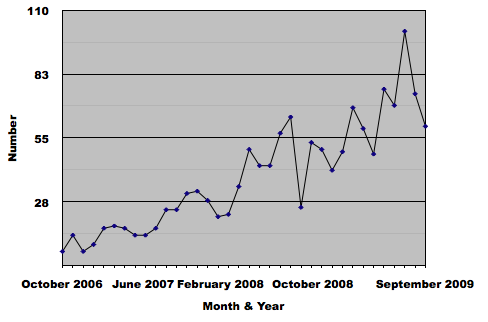

Bank repossessions in Big Bear were up 9% in September though the overall foreclosure filings dropped significantly.

The foreclosure filings in September 2009 (180) were down 18% from August 2009 (219). Year over year, however, filings were up 122% from the September 2008 (81) numbers.

Good news – we are seeing a slow down in the foreclosure numbers. Bad news – the numbers are still too high to be overly excited about the market getting better.

Foreclosure filings are made up of three parts – Notices of Default, a recorded document that starts the foreclosure process. Notices of Sale, a recorded document that sets the date for the Trustee Sale. Trustee Sales, properties that go back to the bank or sold to third parties, generally on the court house steps.

Here’s how the foreclosure numbers broke down for September 2009.

Notices of Default (NOD) – 72 total, down 28% from August but up 200% from September 2008.

Month over month, this was a big drop. Given NODs are the start of the foreclosure process, any consistent reduction in the amount of NODs filed could be the reprieve everyone is looking for. Let’s face it, until the foreclosure numbers slow down, the real estate market recovery is still a big question mark. Once we consistently start to see these numbers start to shrink, we will see a slow down of bank owned properties hitting the market in Big Bear.

Notices of Sale (NOS) – 60 total, down 19% from August but up 140% from September 2008.

This is the second straight month that the NOS numbers have dropped. One explanation for this decrease is the amount of banks that are trying to work with homeowners in foreclosure. Banks would much rather sell the property as a short sale or modify the loan to keep the homeowner in the property than to take it back through foreclosure. Taking a property back involves more money and liability to the bank, something they don’t want.

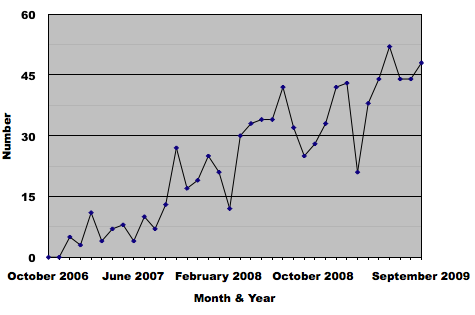

Trustee Sales (Properties that went back to the bank) – 48 total, up 9% from August and up 37% from September 2008.

This is pretty consistent for what we’ve been seeing the whole year, around 40 properties per month in Big Bear are becoming bank owned. These properties will inevitably hit the market for sale.

What can we expect from the near future? There are still hundreds of properties in Big Bear in foreclosure limbo-land, those properties that are in default or even have a notice of sale filed, but are not yet bank owned. Many call this shadow inventory. I’ve seen banks postponing the sale dates on properties for over 6 consecutive months. These properties should be bank owned and on the market for sale, or even sold by now, yet they are not. I also know one Big Bear homeowner that has not made a payment in over 6 months and the bank has not filed a notice of default yet.

The fact is there are so many hands getting involved with the real estate market (read =government), and with these kind of delays in the foreclosure process, it is hard to draw any concrete conclusions. One thing’s for certain, it is still going to be a bumpy ride.

interested in all foreclosures on water w/dock

Hey Tim,

Thanks for the comment. Currently, there is nothing on the water for sale that is a foreclosure. There are several in default that may be coming on the market over the next 6 months. I will send you an email with those ones.

Hi Tim,

Interested in a foreclosures on water and land up to 5 acres w a small cabin somewhat close to Big Bear city. Could you please contact me

Hello A Winter,

I sent you an email, thanks.