August home sales in Big Bear remained flat while the median sales price showed a slight drop, and the average sales price rose moderately.

August home sales in Big Bear remained flat while the median sales price showed a slight drop, and the average sales price rose moderately.

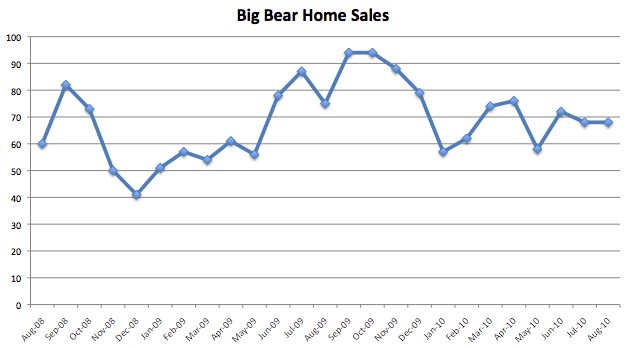

Big Bear Home Sales

Home sales in August (68) were level when compared to the July sales (68). Year over year however, sales were down 9% from August 2009 (75).

20, or 29%, of the 68 sales were bank owned, 7% less than last month. This is one of the lowest months for bank owned sales that we’ve seen in some time. The monthly average is normally in 40-50% range.

7 of the sales, or 10%, were short sales, which is 6% less than last month. We were starting to see rise in the overall percentage of short sales the past few months so this is setback for them.

August was a good month for organic sellers. 41, or 60%, of the Big Bear home sales in August 2010 were organic, or traditional sellers – an increase of 11% from last month. Organic sellers continue to make up over 86% of the available inventory for sale, a pretty large chuck. Compared to the amount of them that are selling ever month, which is between 40-60%, there is still an oversupply. Buyers are more attracted to the bank owned and short sale properties as they believe that is where the deals can be found, and most of the time they are right.

If you are a traditional seller, you’ve got to compete with the REOs and short sales or else you won’t sell.

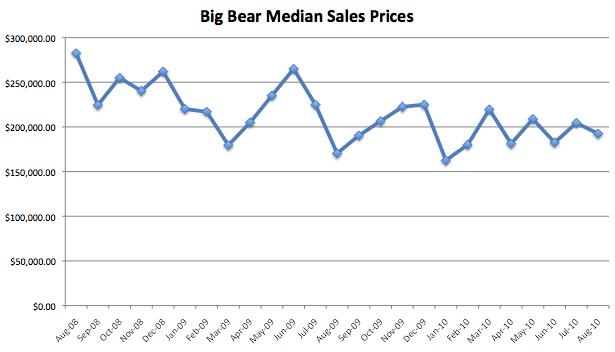

Big Bear Home Prices

The median sales price was down from $204,450 in July to $192,450 in August, a 6% decrease. This number continues to bounce around between $160,000 and $220,000. Year over year, the median sales price was up 8% from the August 2009 median. Still a lot of volatility out there in the market when it comes to prices – all over the board.

The average sales price for homes sold in August 2010 was $278,972, up 8% from the July number of $259,545. This may be attributed to several higher end sales, including 3 Big Bear lakefronts. Year over year, the average sales price is up 12% from the August 2009 average price of $250,120. This is somewhat important as it is the first time I can remember in the past few years where the average sales price is up year over year for the Big Bear area. We’ll see if it continues next month.

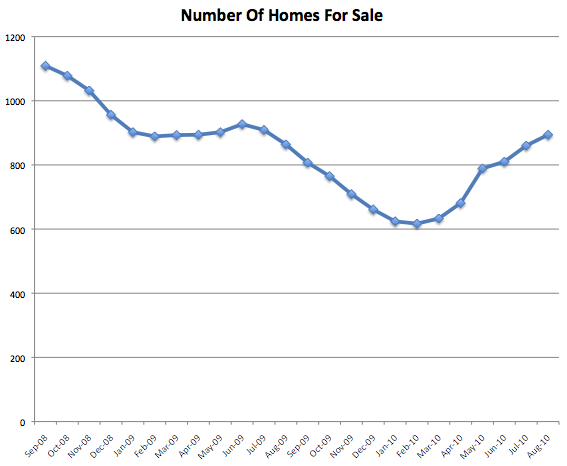

Homes Currently on the Market

Since February, the number of homes on the market has gone from 617 to 894, a 45% increase. We should see this number plateau as we head into the winter months in Big Bear. The only question I have – will we get over 1000 homes for sale?

Month over month, we saw a 4% increase (894 vs. 860) in the amount of available properties.

We hit another milestone this month in the number of homes for sale. For the first time if quite a while, the number of homes on the market increased year over year. There are more homes on the market in Big Bear now than last year. Not great news for sellers but good for buyers I suppose.

Take a look at the graph below – last year at this time we saw a leveling effect, very little gain. Compare that to this year and the rise in homes for sale.

Buyers – the fact still remains that if the one special deal comes up, you have got to move quickly. Though the inventory is increasing, the deals are still going quickly. Every week I see homes come on the market for sales and sell, quickly, for full price or more. That’s reality on the good deals.

Sellers – pricing is still King. You must be the best option available in your price category or else you will just be one of the 800+ that are not selling every month.

Big Bear Home Sales – Thru August 2010

| Month and Year | # Homes For Sale | Median Asking Price | # Homes Sold | Median Sales Price | Average Sales Price |

|---|---|---|---|---|---|

| August 2010 | 894 | $275,000 | 68 | $192,450 | $278,972 |

| July 2010 | 860 | $299,000 | 68 | $204,450 | $258,545 |

| June 2010 | 810 | $295,000 | 72 | $182,500 | $249,756 |

| May 2010 | 789 | $299,000 | 58 | $208,750 | $255,294 |

| April 2010 | 681 | $289,900 | 76 | $181,250 | $229,149 |

| Mar 2010 | 633 | $279,900 | 74 | $219,500 | $256,236 |

| Feb 2010 | 617 | $285,000 | 62 | $180,000 | $254,124 |

| Jan 2010 | 624 | $298,750 | 57 | $162,500 | $216,260 |

| Dec 2009 | 661 | $289,900 | 80 | $227,500 | $312,925 |

| Nov 2009 | 709 | $299,900 | 91 | $219,900 | $257,895 |

| Oct 2009 | 765 | $299,900 | 94 | $206,500 | $294,916 |

| Sept 2009 | 807 | $310,000 | 95 | $184,900 | $239,625 |

| Aug 2009 | 864 | $313,000 | 79 | $178,000 | $250,120 |

| July 2009 | 909 | $309,000 | 87 | $225,000 | $280,787 |

| June 2009 | 927 | $310,000 | 79 | $252,000 | $293,661 |

| May 2009 | 902 | $316,000 | 58 | $226,000 | $309,806 |

| April 2009 | 894 | $300,000 | 63 | $205,000 | $243,669 |

| Mar 2009 | 893 | $299,950 | 58 | $177,000 | $287,996 |

| Feb 2009 | 889 | $309,000 | 58 | $215,500 | $293,295 |

| Jan 2009 | 902 | $319,000 | 51 | $220,000 | $272,571 |

| Dec 2008 | 956 | $320,905 | 44 | $242,250 | $348,906 |

| Nov 2008 | 1032 | $325,000 | 50 | $240,287 | $329,953 |

| Oct 2008 | 1078 | $329,000 | 77 | $255,000 | $343,234 |

| Sept 2008 | 1109 | $328,500 | 82 | $224,500 | $266,170 |

| Aug 2008 | 60 | $282,500 | $328,393 |

Year to Date Comparison (1/1 – 8/31)

| Year | # of Homes Sold | Median Sales Price | Average Sales Price | Days on Market | List Price to Sales Price |

|---|---|---|---|---|---|

| 2010 | 534 | $193,500 | $250,430 | 119 | 96% |

| 2009 | 533 | $215,000 | $278,280 | 131 | 95% |

| 2008 | 416 | $265,000 | $340,439 | 129 | 94% |

| 2007 | 555 | $315,000 | $416,393 | 121 | 96% |

| 2006 | 780 | $315,000 | $393,557 | 77 | 97% |

| 2005 | 1156 | $279,900 | $352,994 | 70 | 98% |

| 2004 | 1206 | $223,500 | $264,904 | 79 | 98% |

| 2003 | 994 | $180,500 | $220,917 | 53 | 98% |

Year-to-Date comparisons – Sales are up by just 1 property from 2009, but 28% from 2008. The median and average prices are down 9% and 10% respectively from 2009, while compared to 2008 – down 27% and 26% respectively. Today’s prices are in the 03/04 range.

If you’re asking about the market, be sure to know what you are asking about. People are always wondering how the real estate market in Big Bear is doing. And my answer is always, “It depends.” Currently, sales are okay but slow, and prices are still down from the peak.

Compare 2010 to 2003. If someone asked how the market was in 2003, most people would say, “great,” as sales were up. But, prices were lower then than they are today. And today most agents say, “not great,” as sales are much lower even though prices are now higher than 2003 levels. Guess it depends on what you are asking about, sales or prices? I think most people are just concerned about prices.

Til next month,

Want more? Be sure to sign up for our email newsletter or RSS feed.

* Note: The charts above are updated on a monthly basis. They represent single family home sales in the Big Bear area, including Big Bear Lake, Big Bear City, Moonridge, Fox Farm, Sugarloaf, Erwin Lake, & Fawnskin. Data courtesy of the Big Bear MLS. These numbers do not include raw land or condos nor does it include homes in the Big Bear MLS that are located out of the Big Bear area or home sales not listed in the Big Bear MLS.

Related Articles

Big Bear Home Sales – July 2010

Big Bear Home Sales – June 2010 & Second Quarter 2010

Speak Your Mind