The number of homes for sale in Big Bear continued its upward rise in June. The median sales price jumped around again, something we’ve seen a lot of the past 6 months, while the average sales price remained nearly the same, and Big Bear homes sales picked back up in June.

The number of homes for sale in Big Bear continued its upward rise in June. The median sales price jumped around again, something we’ve seen a lot of the past 6 months, while the average sales price remained nearly the same, and Big Bear homes sales picked back up in June.

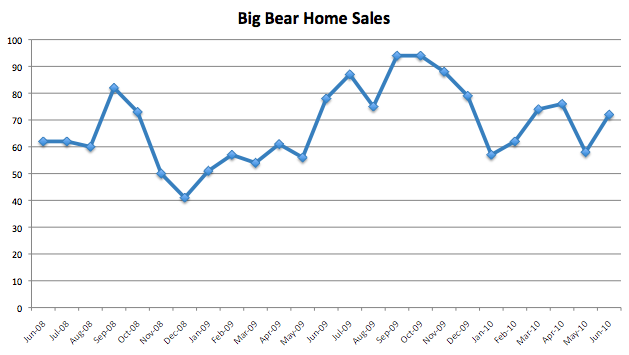

Big Bear Home Sales

Home sales in June were up 24% when compared to the May sales (72 v. 58). That is a nice increase but considering May was one of the slowest months we’ve seen the past year, 72 home sales is about average for Big Bear right now. Year over year, sales are down 9% from June 2009 (72 v. 79).

24, or 33%, of the 72 home sales in Big Bear were bank owned, 9% less than last month. 40-50% per month is about the average we’ve been seeing, so this was a low month for REO sales.

10 of the sales, or 14%, were short sales, which is 3% more than last month. This is slightly higher than the amount on the market – 8% of the homes that are for sale are short sales. With all the news and hype you hear about short sales, they make up a small percentage of what sells every month. 80-90% of what is selling in Big Bear is either REO (bank owned) or traditional (organic) sellers.

38, or 53%, of the Big Bear home sales in June 2010 were organic, or traditional sellers – an increase of 6% from last month. Organic sellers continue to make up over 80% of the available inventory, yet only about half of what is selling every month. Buyers are more attracted to the bank owned and short sale properties as they believe that is where the deals can be found. Most of the time they are right. If you are a traditional seller, you’ve got to compete with the REOs and short sales or else you won’t sell.

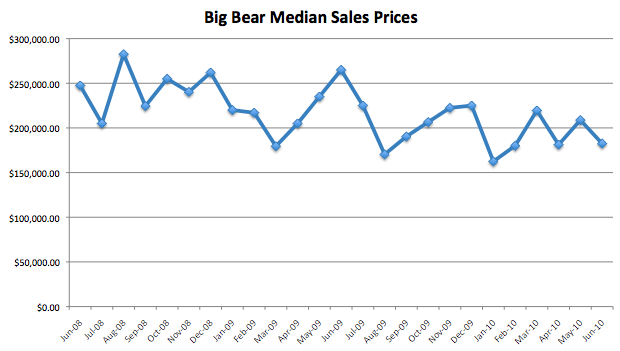

Big Bear Home Prices

The median sales price was down from $208,750 in May to $182,500 in June, a 13% decrease. This number continues to bounce around between $160,000 and $220,000. Year over year, the median sales price was down 28% from the June 2009 median. Still a lot of volatility out there in the market when it comes to prices – all over the board.

The average sales price for homes sold in June 2010 was $249,756, down 2% from the May number of $255,294. Year over year, however, the average sales price is down 15% from the June 2009 average price of $299,661.

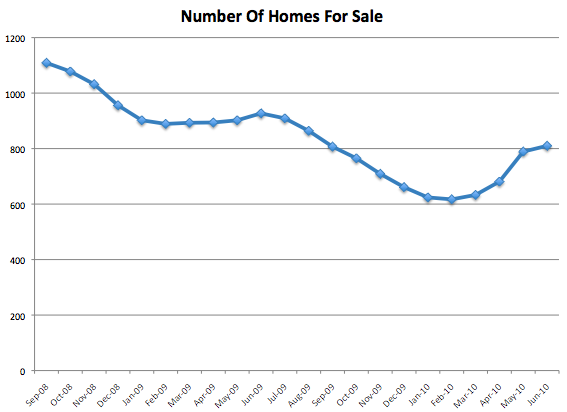

Homes Currently on the Market

The number of homes for sale in Big Bear continues to rise. Nothing too steep, but a steady rise all the same. For the fourth straight month, the number of homes for sale in Big Bear rose month over month. A 3% increase (810 vs. 789) is quite a bit less than we saw last month, but still higher. Higher amounts of inventory means more competition and lowering of prices so keep tabs on this number. One thing is still for sure, inventory is increasing in Big Bear. This should open up some more options for buyers, and put a little softening in the prices.

It is also still important to note, however, that the year over year number of homes for sale in Big Bear is still down 13% from June 2009 (810 vs. 927). This margin is decreasing. Take a look at the graph below – last year at this time we saw a leveling effect, very little gain. Compare that to this year and the rise in homes for sale. It appears to be leveling but too early to tell on that.

Buyers – the fact still remains that if the one special deal comes up, you gotta move quickly. Though the inventory is increasing, the deals are still going quickly. Every week I see homes come on the market for sales and sell, quickly, for full price or more. That’s reality on the good deals.

Time will tell what is going to happen this summer. Will we get over 1000 homes for sale in Big Bear? Let me know your thoughts.

Big Bear Home Sales – Thru June 2010

| Month and Year | # Homes For Sale | Median Asking Price | # Homes Sold | Median Sales Price | Average Sales Price |

|---|---|---|---|---|---|

| June 2010 | 810 | $295,000 | 72 | $182,500 | $249,756 |

| May 2010 | 789 | $299,000 | 58 | $208,750 | $255,294 |

| April 2010 | 681 | $289,900 | 76 | $181,250 | $229,149 |

| Mar 2010 | 633 | $279,900 | 74 | $219,500 | $256,236 |

| Feb 2010 | 617 | $285,000 | 62 | $180,000 | $254,124 |

| Jan 2010 | 624 | $298,750 | 57 | $162,500 | $216,260 |

| Dec 2009 | 661 | $289,900 | 80 | $227,500 | $312,925 |

| Nov 2009 | 709 | $299,900 | 91 | $219,900 | $257,895 |

| Oct 2009 | 765 | $299,900 | 94 | $206,500 | $294,916 |

| Sept 2009 | 807 | $310,000 | 95 | $184,900 | $239,625 |

| Aug 2009 | 864 | $313,000 | 79 | $178,000 | $250,120 |

| July 2009 | 909 | $309,000 | 87 | $225,000 | $280,787 |

| June 2009 | 927 | $310,000 | 79 | $252,000 | $293,661 |

| May 2009 | 902 | $316,000 | 58 | $226,000 | $309,806 |

| April 2009 | 894 | $300,000 | 63 | $205,000 | $243,669 |

| Mar 2009 | 893 | $299,950 | 58 | $177,000 | $287,996 |

| Feb 2009 | 889 | $309,000 | 58 | $215,500 | $293,295 |

| Jan 2009 | 902 | $319,000 | 51 | $220,000 | $272,571 |

| Dec 2008 | 956 | $320,905 | 44 | $242,250 | $348,906 |

| Nov 2008 | 1032 | $325,000 | 50 | $240,287 | $329,953 |

| Oct 2008 | 1078 | $329,000 | 77 | $255,000 | $343,234 |

| Sept 2008 | 1109 | $328,500 | 82 | $224,500 | $266,170 |

| Aug 2008 | 60 | $282,500 | $328,393 | ||

| July 2008 | 63 | $205,000 | $277,250 | ||

| June 2008 | 62 | $247,500 | $319,579 |

Second Quarter Comparisons (4/1 – 6/30)

| Year | # of Homes Sold | Median Sales Price | Average Sales Price | Days on Market | List Price to Sales Price |

|---|---|---|---|---|---|

| 2010 | 206 | $190,000 | $243,713 | 110 | 95% |

| 2009 | 200 | $230,000 | $282,595 | 127 | 95% |

| 2008 | 180 | $278,795 | $340,689 | 133 | 94% |

| 2007 | 196 | $339,450 | $472,228 | 122 | 95% |

| 2006 | 308 | $305,000 | $381,327 | 72 | 97% |

| 2005 | 473 | $277,000 | $354,825 | 68 | 98% |

| 2004 | 492 | $224,450 | $229,980 | 81 | 98% |

| 2003 | 371 | $180,000 | $218,456 | 49 | 97% |

Second quarter comparisons – Sales were up 3% from 2009, and 14% from 2008. The median and average prices are each down 17% and 14% respectively from 2009, while compared to 2008 – down 32% and 28% respectively.

When people ask me how the market is, I typically tell them sales are consistent and prices are down. The chart above is a good example of that. Sales in Big Bear have not fluctuated a whole lot the past 4 years, but prices sure have. Compare the last 4 years of sales and then look at the prices. That’s the current market in a nutshell.

Year to Date Comparison (1/1 – 6/30)

| Year | # of Homes Sold | Median Sales Price | Average Sales Price | Days on Market | List Price to Sales Price |

|---|---|---|---|---|---|

| 2010 | 399 | $185,000 | $243,731 | 122 | 95% |

| 2009 | 367 | $220,000 | $283,747 | 131 | 94% |

| 2008 | 293 | $279,000 | $356,493 | 134 | 94% |

| 2007 | 409 | $330,000 | $420,823 | 121 | 96% |

| 2006 | 586 | $318,000 | $394,127 | 75 | 97% |

| 2005 | 800 | $273,000 | $341,074 | 77 | 98% |

| 2004 | 853 | $215,000 | $257,814 | 85 | 98% |

| 2003 | 721 | $177,000 | $216,101 | 51 | 98% |

Year-to-Date comparisons – Sales are up 9% from 2009, and 36% from 2008. The median and average prices are each down 16% and 14% respectively from 2009, while compared to 2008 – down 34% and 32% respectively.

Prices still look to be in the 2003/2004 range. Interesting to see how many homes we were selling back in 2003-2006 and compare the prices. We were selling over twice as many homes in 2004, the market was a lot more active, yet prices were about the same as they are now. Compare that to 2007 and 2008, where sales were the same or less than they are now, but price were much higher. I guess it really does not matter how many homes are selling, sellers just want someone to “show them the money!”

Want more? Be sure to sign up for our email newsletter or RSS feed.

* Note: The charts above are updated on a monthly basis. They represent single family home sales in the Big Bear area, including Big Bear Lake, Big Bear City, Moonridge, Fox Farm, Sugarloaf, Erwin Lake, & Fawnskin. Data courtesy of the Big Bear MLS. These numbers do not include raw land or condos nor does it include homes in the Big Bear MLS that are located out of the Big Bear area or home sales not listed in the Big Bear MLS.

Related Articles

Big Bear Home Sales – May 2010

Big Bear Home Sales – April 2010

Speak Your Mind