Home sales in Big Bear jumped in March 2010. First quarter sales are up while prices are still down.

Home sales in Big Bear jumped in March 2010. First quarter sales are up while prices are still down.

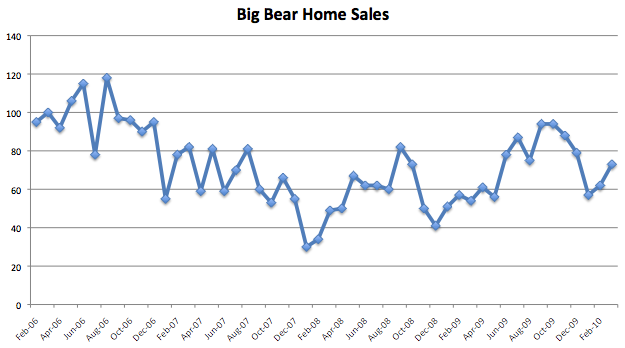

Big Bear Home Sales

Home sales in March were up 18% when compared to the February sales (73 v. 62). Year over year, sales are up 26% from March 2009, encouraging news for the market. Compared to March 2008, sales were up 49%!

34, or 47%, of the 73 home sales in Big Bear were bank owned, about 8% more than last month and one of the highest months for bank owned sales in Big Bear we’ve seen in the past 6 months.

13 of the sales, or 18%, were short sales, which is 5% more than last month and one of the first times I’ve seen more than 10 short sales close in one month. Could this be the beginning of the short sale surge some people have been talking about? There are a lot in the pipeline but a small percentage of those have been closing. With the new HAFA program by the Federal Government taking effect on April 5th, which is intended to streamline the short sale process, we just might start seeing more short sales actually closing. I am not going to hold my breathe on that though.

26, or only 36%, of the Big Bear home sales in March 2010 were “organic”, or traditional sellers – a decrease of 12% from last month. This is an important number to keep an eye on. Organic sellers make up a majority of what is on the market for sale, 83% to be accurate. And yet they only made up 36% of what sold in March. Conversely, bank owned and short sales homes in Big Bear make up 17% of what is currently for sale yet they made up 64% of what sold in March. Can you see what the Big Bear home buyers are biting on?

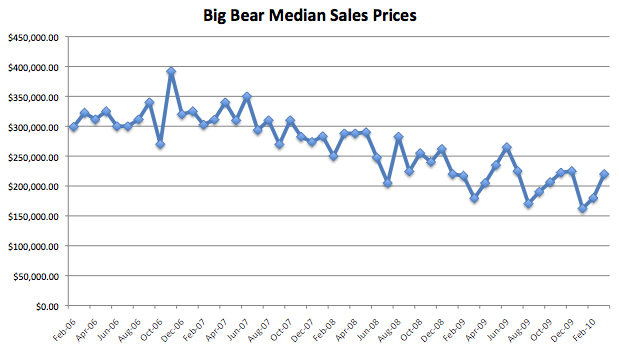

Big Bear Home Prices

The median sales price jumped from $180,000 in Feb. 2010 to $220,0000 in March 2010, a 22% increase. And year over year, the median sales price was up 24% from the March 2009 median. The median sales price tends to fluctuate quite a bit with limited sales so the average sales price might be a better indicator of what prices are doing right now.

The average sales price for homes sold in March 2010 was $257,623, up just 1% from the average sales price in Feb., $254,124. Year over year however, the average sales price is down 11% from the March 2009 average price of $287,996. Compared to the median, this appears to be a more realistic indicator of what is happening to home prices in Big Bear.

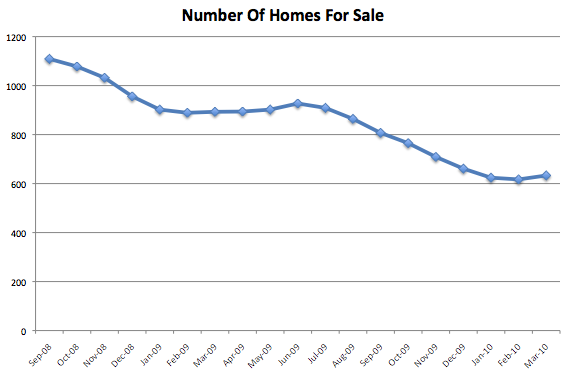

Homes Currently on the Market

For the first time in over 8 months, the number of homes for sale in Big Bear rose month over month. It was a slight increase, only 16, or 3% (633 vs. 617), but important nonetheless. Part of what has been keeping this market going, and prices somewhat level, has been the low inventory. Higher inventory means more competition and lowering of prices.

Year over year, the number of homes for sale in Big Bear is still down 29% from March 2009 (633 vs. 893).

This is typically the time where we should start to see a buildup of homes coming on the market and thereby a higher number of inventory. But, as you can see from last year, that did not happen. My gut tells me we will see an increase, probably in the 700-800 total range.

My advice from month’s past still remains –

The reality of lower inventory is showing up everyday in the market. Properly priced homes are coming on the market and have 3-4 offers within a week period. There are still a low amount of options for sale, and the buyers are all looking at the same properties.

If you are trying to sell, and you are not seeing any activity, you have to ask yourself why?

For sellers, this is why it is extremely important to price your property correctly in the beginning. The first 30 days are crucial to a successful sale. Miss that opportunity and you will be fighting uphill the rest of the way as it’s very hard to get back in the buyer spotlight.

For buyers, if something good comes on the market, you can be assured that you will be competing against more than one buyer.

Big Bear Home Sales – Thru March 2010

| Month and Year | # Homes For Sale | Median Asking Price | # Homes Sold | Median Sales Price |

|---|---|---|---|---|

| Mar 2010 | 633 | $279,900 | 73 | $220,000 |

| Feb 2010 | 617 | $285,000 | 62 | $180,000 |

| Jan 2010 | 624 | $298,750 | 57 | $162,500 |

| Dec 2009 | 661 | $289,900 | 79 | $225,000 |

| Nov 2009 | 709 | $299,900 | 88 | $222,450 |

| Oct 2009 | 765 | $299,900 | 94 | $206,500 |

| Sept 2009 | 807 | $310,000 | 94 | $190,358 |

| Aug 2009 | 864 | $313,000 | 75 | $170,400 |

| July 2009 | 909 | $309,000 | 87 | $225,000 |

| June 2009 | 927 | $310,000 | 78 | $265,000 |

| May 2009 | 902 | $316,000 | 56 | $235,000 |

| April 2009 | 894 | $300,000 | 61 | $205,000 |

| Mar 2009 | 893 | $299,950 | 58 | $177,000 |

| Feb 2009 | 889 | $309,000 | 58 | $215,500 |

| Jan 2009 | 902 | $319,000 | 51 | $220,000 |

| Dec 2008 | 956 | $320,905 | 41 | $262,000 |

| Nov 2008 | 1032 | $325,000 | 50 | $240,287 |

| Oct 2008 | 1078 | $329,000 | 73 | $255,000 |

| Sept 2008 | 1109 | $328,500 | 82 | $224,500 |

| Aug 2008 | 60 | $282,500 | ||

| July 2008 | 62 | $205,000 | ||

| June 2008 | 62 | $247,500 | ||

| May 2008 | 67 | $290,000 | ||

| April 2008 | 50 | $299,500 | ||

| Mar 2008 | 1082 | $339,950 | 49 | $288,000 |

First quarter comparisons – Sales are up 15% from 2009, and 70% from 2008. The median and average prices are each down 8% and 14% respectively from 2009, while compared to 2008 – down 34% and 36% respectively.

Comparing the numbers of 2004 to 2010 – median and average pries are very similar. Sales are still way down.

The list price to sales price ratio rose 1%, from 95% to 96% in the first quarter this year. I think this can be chalked up to the lower amount of homes for sale, and thus tighter pricing on those that are selling.

First Quarter Comparison (1/1 – 3/31)

| Year | # of Homes Sold | Median Sales Price | Average Sales Price | Days on Market | List Price to Sales Price |

|---|---|---|---|---|---|

| 2010 | 192 | $183,450 | $244,213 | 135 | 96% |

| 2009 | 167 | $200,000 | $285,126 | 135 | 95% |

| 2008 | 113 | $279,000 | $381,668 | 135 | 95% |

| 2007 | 213 | $312,000 | $373,521 | 120 | 96% |

| 2006 | 278 | $322,250 | $408,308 | 77 | 97% |

| 2005 | 327 | $268,000 | $321,183 | 90 | 97% |

| 2004 | 361 | $198,000 | $241,232 | 91 | 97% |

| 2003 | 350 | $173,125 | $213,606 | 53 | 98% |

Want more? Be sure to sign up for our email newsletter or RSS feed.

* Note: The charts above are updated on a monthly basis. They represent single family home sales in the Big Bear area, including Big Bear Lake, Big Bear City, Moonridge, Fox Farm, Sugarloaf, Erwin Lake, & Fawnskin. Data courtesy of the Big Bear MLS. These numbers do not include raw land or condos nor does it include homes in the Big Bear MLS that are located out of the Big Bear area or home sales not listed in the Big Bear MLS.

Related Articles

Big Bear Home Sales – January 2010

Speak Your Mind