Fact: 1/3 of all Short Sales do not close escrow. There's either too many liens on a property, the bank won't accept the short sale, or the buyer backs out because they're tired of waiting on the bank to make a decision. Below are a few things I would recommend if you're considering making an offer on a short sale home to help make the process go as smoothly as possible from the buyers' side of the transaction: 1). Has the Short Sale been Approved by the Lender? If the bank has already accepted the price and … [Read more...]

Secrets to a Successful Big Bear Short Sale: Buying A Short Sale Home

What’s Best? Bank Owned, Short Sale, or Traditional Seller?

Many buyer's in today's market think that the deal is more important than the house. They often get caught up in the misconception that bank owned or short sale properties are the only homes that they should look at. This would be a grave mistake. Even though it is true that the bank owned and short sale properties are driving the Big Bear Real Estate market, we are still selling many units that are listed by traditional sellers. What's best? It's best to select a home that fits your needs, is in a good location, … [Read more...]

Secrets to a Successful Big Bear Short Sale: The Application Process

More and more short sales are getting approved in the Big Bear real estate market these days. Banks simply don't want to take a property back and by completing a short sale the banks save time, money, and they get the property off their books. As a seller, you avoid the stress of a lengthy foreclosure process and you can preserve your credit rating. What is a Short Sale? A short sale is a procedure in which the borrower is allowed to sell the property for an amount less than which is owed in order to avoid … [Read more...]

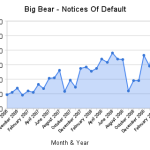

Big Bear Foreclosure Numbers – April 2009

The foreclosure filings for Big Bear (notices of default, notices of trustee sale, and properties that went back to the bank) in April 2009 were down 5% as compared to March 2009. But, they were up 20% when compared to April 2008, or year over year. There were a total of 92 properties in the Big Bear area that received a notice of default in April, which is down 14% from the all-time high we saw in March 2009. Even though there was a decline, 92 is still on the very high end of the range (see the chart below) … [Read more...]

March 2009 – Foreclosure Numbers For The Big Bear Real Estate Market

Notices of Default (NOD) in Big Bear eclipsed the 100 mark for the first time in history during March 2009. Up 13% from the previous high of 95 NODs in February 2009, the new record set in March was 107 NODs. This means more and more properties in the Big Bear area going into default, a majority of which will most likely be bank owned in 6-12 months. While the NODs were up, the Notices of Sale (NOS) and the number on properties that went back to the bank were down. NOSs were down 13% in March, from 68 in … [Read more...]

Big Bear Real Estate Market – Monthly Foreclosure Numbers February 2009

In order to know where we are going as a real estate market, it is important to see where we have been in the past. Without running the numbers and creating the foreclosure charts below, it would be impossible to really forecast what is coming down the pike in Big Bear. That said, the number of notices of default, notices of sale, and properties that went back to the bank in February 2009 were the highest we have seen since the tracking started in October of 2006. What does this mean? We are going to see many … [Read more...]

Bank Owned & Short Sale Homes Taking Market Share In Big Bear

Active Listings % of Total Pending Listings % of Total Sold Listings Last Year % of Total Mom & Pop Seller 775 83% 36 31% 534 80% Bank Owned 69 7% 52 46% 115 17% Short Sales 89 10% 26 23% 18 3% Total 933 114 667 As evidenced in the table above, bank owned and short sale homes have taken a larger piece of the overall real estate pie here in Big Bear. 80% of the home sales in Big Bear for 2008 were your traditional, Mom & Pop seller. That made sense as there was a similar percentage, 90-95%, … [Read more...]

More Evidence Of The Bank-Owned, REO Mentality

Home buyers today are of the "Bank-Owned/REO Mentality." They want to buy something with that kind of price tag, regardless of who owns it. I came across an article from CNNMoney that really hits home on what is going on in the current housing market. If you want to sell a home in this market, no matter how much it hurts, you need to price your home like a bank-owned or REO property. That is your competition. The tough part about this is that bank-owned or REO properties are priced 20-40% less than the non-REO … [Read more...]