Homes listed for sale plummeted across 96% of major U.S. markets and the Big Bear real estate market is looking to be on the same path. If you asked an economist why home prices have broadly fallen over the past 2 years, you'd get a short lesson in Supply and Demand. Too many homes for sale and not enough people to buy them pushed values lower until a balance point can be reached. Looking at the chart at right, that balance point may be fast approaching. According to data compiled by ZipRealty, the total number … [Read more...]

Is The Real Estate Market Bottoming Out? Some Signs Are Saying Yes.

Big Bear Real Estate Monday Market Update For 3/2/2009

Below is your weekly update for the Big Bear real estate market as of 3/2/2009. Property Type Listings for Sale Change from Last Week Pending Sales Change from Last Week Sales Year to Date Change from Last Week RESIDENTIAL 887 -21 113 -2 99 +13 VACANT LAND 359 -2 9 -1 4 +1 CONDOS 45 -1 5 -1 2 +1 GOVERNMENT LEASE 12 0 0 0 0 0 COMMERCIAL & RES INVESTMENT 55 +1 4 0 1 0 BUSINESS OPPORTUNITY 13 +2 0 0 0 0 TOTAL 1371 -21 131 -4 106 +15 A few notes about the market - The residential inventory is … [Read more...]

Big Bear Real Estate Monday Market Update For 2/23/2009

Below is your weekly update for the Big Bear real estate market as of 2/23/2009. Property Type Listings for Sale Change from Last Week Pending Sales Change from Last Week Sales Year to Date Change from Last Week RESIDENTIAL 908 -1 115 -6 86 +16 VACANT LAND 361 +16 10 0 3 +1 CONDOS 46 0 6 -1 1 0 GOVERNMENT LEASE 12 0 0 0 0 0 COMMERCIAL & RES INVESTMENT 54 +2 4 0 1 +1 BUSINESS OPPORTUNITY 11 0 0 0 0 0 TOTAL 1392 +17 135 -7 91 +18 A few notes about the market - Home sales for the year now stand … [Read more...]

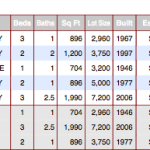

Absorption Rates For The Big Bear Real Estate Market – January 2009

If you are thinking of buying or selling a home in Big Bear, you may want to take a look at the absorption rate of homes that are currently for sale. Knowing the absorption rate is a great way to become more informed on the current real estate market conditions in a particular area. In simplistic terms, it is a mathematical equation that tells you the amount of time it will take for a specified set amount of properties to be absorbed under current real estate market conditions. Generally speaking, the higher … [Read more...]

Big Bear Real Estate Monday Market Update For 2/16/2009

Below is your weekly update for the Big Bear real estate market as of 2/16/2009 (Happy President's Day!). Property Type Listings for Sale Change from Last Week Pending Sales Change from Last Week Sales Year to Date Change from Last Week RESIDENTIAL 909 +5 121 -8 70 +13 VACANT LAND 345 +1 10 -1 2 +1 CONDOS 46 -1 7 +1 1 0 GOVERNMENT LEASE 12 0 0 0 0 0 COMMERCIAL & RES INVESTMENT 52 0 4 0 0 0 BUSINESS OPPORTUNITY 11 0 0 0 0 0 TOTAL 1375 +5 142 -8 73 +14 A few notes about the market - Home sales … [Read more...]

Big Bear Real Estate Monday Market Update For 2/9/2009

Below is your weekly update for the Big Bear real estate market as of 2/9/2009 (a very snowy day I might add). Property Type Listings for Sale Change from Last Week Pending Sales Change from Last Week Sales Year to Date Change from Last Week RESIDENTIAL 904 -2 129 +3 57 +17 VACANT LAND 344 +10 11 -2 1 +1 CONDOS 47 -1 6 0 1 0 GOVERNMENT LEASE 12 +1 0 0 0 0 COMMERCIAL & RES INVESTMENT 52 +2 4 +1 0 0 BUSINESS OPPORTUNITY 11 0 0 0 0 0 TOTAL 1370 +10 150 +2 59 +18 A few notes about the market … [Read more...]

Job Growth Numbers Not A Great Sign For Big Bear Real Estate Market

If job growth & housing numbers are related, today's news is not a great sign for the real estate market in Big Bear. Employment figures released this morning show that the economy has now shed 3.6 million jobs since December 2007, included close to half that in the last 3 months alone. The Unemployment Rate is now 7.6%. But jobs aren't fading in every housing market equally. As reported by Ajilon Professional Staffing, there are still areas around the country in which unemployment rates are low and job … [Read more...]

Lower Mortgage Rates Impact Home Affordability

Comparing July's conforming mortgage rates to today's average rates, there's a 1.5 percent difference in favor of homeowners. Rate drops like that make big differences in a household budget. Look at these before-and-after payments, based on rates from the chart: $150,000 mortgage ($144 savings/month) July 2008: $958 monthly February 2009: $814 monthly $250,000 mortgage ($240 savings/month) July 2008: $1,597 monthly February 2009: $1,357 monthly $350,000 mortgage ($335 savings/month) July 2008: $2,235 … [Read more...]

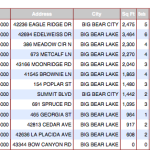

Big Bear Home Sales – January 2009

Home sales in Big Bear for January 2009 (47) were up 37% as compared to January 2008 (30), and 13% compared to December 2008 (41). January is normally one of the 4 slowest months of the year for sales so this is pretty good news all things considered. 25, or 59%, of the 47 home sales in Big Bear, were either bank owned or short sales. This is up from 44% of the total sales last month. I suspect this number will continue to rise this year. Not great news but we have to get them sold in order to get through this … [Read more...]

Home Buyers Are Getting Off Of The Fence

The National Association of Realtors reported Tuesday that Pending Home Sales ticked higher in December 2008. A "pending home sale" is a home under contract to sell, sometimes referred to as "in escrow", but not yet closed. The group positions Pending Home Sales report as a predictor of future activity, suggesting that home sales will spike 60 days hence. This is good news for the economy. However, despite the Pending Home Sales report's correlation to the actual number of homes sold in the future, that … [Read more...]