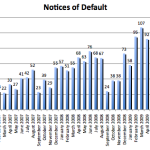

Foreclosure filings in Big Bear were down 14% in January 2010 when compared to December 2009. Year over year, foreclosure filings were down 7% from the January 2009 numbers. This is kinda big news as it is the first time in more than a year that I can recall the overall foreclosure filings down year over year. A sign of things getting better? I don't think so. Keep in mind, foreclosure filings are made up of three parts - Notices of Default (NOD), a recorded document that starts the foreclosure process, which … [Read more...]

Big Bear Short Sales? Don’t Waste Your Time!

If you don't see the embedded video, click here. If you are looking for a deal in Big Bear, focus on the homes that can be sold. In 2009, 80 short sale homes actually closed escrow. That is 9% of the 893 homes that closed in the Big Bear MLS. Currently there are 66 short sale listings that are in Pending, Active Contingent, or Contingent Status. That's 39% of the total Pending, Active Contingent, or Contingent Status (170). Anyone want to guess what percentage of these will actually get accepted by the bank … [Read more...]

Big Bear Home Sales – January 2010

As expected, home sales in Big Bear dropped in January. Sales in January represent buying activity in November and December - and peak holiday season = slow home buying season. The median sales price dropped significantly as well. Big Bear Home Sales Home sales in January were down 29% when compared to the December sales (56 v. 79). On a brighter note, sales were up 10% when compared to the same month last year (56 v. 51). Given that January thru April are the 4 slowest months of the year for sales, this number … [Read more...]

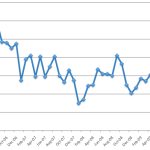

When’s The Best Time To Sell A House In Big Bear?

Click here if you cannot see embedded video. Guess it depends on how you look at it. The majority of home sales in Big Bear occur in the months between July and October, with the closings following 30-60 days after that. But, this is also when the market carries the largest amount of properties for sale. Another way to look at it - you have more buyers looking to buy but also more sellers looking to sell. Conversely, there are less buyers in the November to May time frame but also less sellers on the market … [Read more...]

2009 Big Bear Real Estate Market Recap

The real estate market in Big Bear for 2009 can be summed up in 9 words - Sales up, Prices down but stabilizing, & Inventory shrinking. Did you count? :). Big Bear home sales rose 33% in 2009 while the median and average sales prices dropped 17% from the 2008 numbers. Year to Year Comparison Year # of Homes Sold Median Sales Price Average Sales Price Days on Market List Price to Sales … [Read more...]

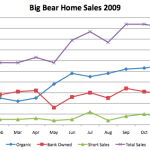

Big Bear Home Sales – December 2009

Big Bear Home Sales Sorry I've been so late on posting these. To say things are busy right now in the Big Bear real estate market would be a huge understatement. So, here we go. Big Bear home sales slipped a bit in December but overall still remain strong. Home sales in December were down 10% when compared to the November sales (79 v. 88), but were up 93% when compared to the same month last year (79 v. 41). The second number really shows you how much better sales are doing this year compared to last year. … [Read more...]

Lack of Buyers?

Click here to see embedded video. Nope. There are actually plenty of buyers out there in this market. There are, however, very few willing to pay the over-inflated asking price of many sellers. The reality is there are very few realistic sellers on the market. We don't have a lack of buyers. Rather, we have a lack of realistically priced properties for buyers to choose from. Related Articles Should I Price It Firm Or Flexible? Actions Speak Louder Than Words In Real Estate The Right Asking Price Makes All … [Read more...]

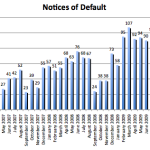

Big Bear Foreclosure Numbers – November 2009

Foreclosure filings in Big Bear were down 28% in November 2009 when compared to the previous month. Year over year, foreclosure filings were up 23% from the November 2008 numbers. Notices of default dropped to the lowest number we've seen in a year, while notices of sales and trustee sales back to the bank remained near their monthly average. There are several potential reasons for the drop in defaults - the lull of the holiday season, banks giving borrowers more time and options to resolve the delinquent … [Read more...]