Foreclosure filings in Big Bear jumped 23% in February 2010 when compared to January. Year over year however, foreclosure filings were down 22% from the February 2009 numbers, the second straight month that foreclosure filings were down year over year. Keep in mind, foreclosure filings are made up of three parts - Notices of Default (NOD), a recorded document that starts the foreclosure process, which is normally filed after homeowners fall behind in their payments. Notices of Sale (NOS), a recorded document … [Read more...]

Big Bear Foreclosure Numbers – January 2010

Foreclosure filings in Big Bear were down 14% in January 2010 when compared to December 2009. Year over year, foreclosure filings were down 7% from the January 2009 numbers. This is kinda big news as it is the first time in more than a year that I can recall the overall foreclosure filings down year over year. A sign of things getting better? I don't think so. Keep in mind, foreclosure filings are made up of three parts - Notices of Default (NOD), a recorded document that starts the foreclosure process, which … [Read more...]

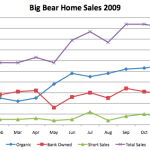

2009 Big Bear Real Estate Market Recap

The real estate market in Big Bear for 2009 can be summed up in 9 words - Sales up, Prices down but stabilizing, & Inventory shrinking. Did you count? :). Big Bear home sales rose 33% in 2009 while the median and average sales prices dropped 17% from the 2008 numbers. Year to Year Comparison Year # of Homes Sold Median Sales Price Average Sales Price Days on Market List Price to Sales … [Read more...]

Big Bear Foreclosure Numbers – November 2009

Foreclosure filings in Big Bear were down 28% in November 2009 when compared to the previous month. Year over year, foreclosure filings were up 23% from the November 2008 numbers. Notices of default dropped to the lowest number we've seen in a year, while notices of sales and trustee sales back to the bank remained near their monthly average. There are several potential reasons for the drop in defaults - the lull of the holiday season, banks giving borrowers more time and options to resolve the delinquent … [Read more...]

Big Bear Bank Owned Homes – Assumptions Are Not Always True

There are a lot of assumptions about buying bank owned properties in Big Bear. Here are a couple that I see a lot. 1. Banks or REO sellers will take a lot less than the list price. 2. The listing price for a bank owned property is going to be aggressive. Click here to see embedded video. The fact is bank owned homes in Big Bear are selling closer to the list price than organic sales, 97% vs. 95%. Many times, banks will price their properties so aggressive that they receive multiple offers that go over full … [Read more...]

Big Bear Foreclosure Numbers – July 2009

Foreclosure numbers in Big Bear are still on the rise. The foreclosure filings in July 2009 were up 16% from June 2009, and 81% from July 2008. Keep in mind, foreclosure filings are made up of Notices of Default, a recorded document that starts the foreclosure process, Notices of Sale, a recorded document that sets the date for the Trustee Sale, and lastly, Trustee Sales, properties that go back to the bank or sold to third parties. While the overall news on the real estate market may appear to be getting … [Read more...]

Big Bear Foreclosure Numbers – May 2009

If the foreclosure market has anything to say about how long this down market will last, don't expect things to get better anytime soon. Foreclosure filings in Big Bear were up 20% in May 2009 compared to April 2009. And year over year, foreclosure filings were up 53% as compared to May 2008. Foreclosure filings, which are made up on Notices of Default (NOD), Notices of Trustee Sale (NTS), and Trustee Sales, are a good indicator of the future health of any real estate market. Accordingly, the real estate market … [Read more...]

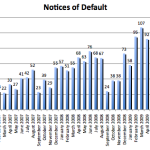

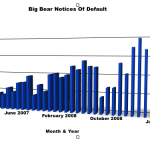

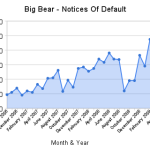

March 2009 – Foreclosure Numbers For The Big Bear Real Estate Market

Notices of Default (NOD) in Big Bear eclipsed the 100 mark for the first time in history during March 2009. Up 13% from the previous high of 95 NODs in February 2009, the new record set in March was 107 NODs. This means more and more properties in the Big Bear area going into default, a majority of which will most likely be bank owned in 6-12 months. While the NODs were up, the Notices of Sale (NOS) and the number on properties that went back to the bank were down. NOSs were down 13% in March, from 68 in … [Read more...]