In order to know where we are going as a real estate market, it is important to see where we have been in the past. Without running the numbers and creating the foreclosure charts below, it would be impossible to really forecast what is coming down the pike in Big Bear. That said, the number of notices of default, notices of sale, and properties that went back to the bank in February 2009 were the highest we have seen since the tracking started in October of 2006. What does this mean? We are going to see many … [Read more...]

Big Bear Real Estate Market – Monthly Foreclosure Numbers February 2009

Big Bear Real Estate Monday Market Update For 2/23/2009

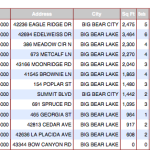

Below is your weekly update for the Big Bear real estate market as of 2/23/2009. Property Type Listings for Sale Change from Last Week Pending Sales Change from Last Week Sales Year to Date Change from Last Week RESIDENTIAL 908 -1 115 -6 86 +16 VACANT LAND 361 +16 10 0 3 +1 CONDOS 46 0 6 -1 1 0 GOVERNMENT LEASE 12 0 0 0 0 0 COMMERCIAL & RES INVESTMENT 54 +2 4 0 1 +1 BUSINESS OPPORTUNITY 11 0 0 0 0 0 TOTAL 1392 +17 135 -7 91 +18 A few notes about the market - Home sales for the year now stand … [Read more...]

More Evidence Of The Bank-Owned, REO Mentality

Home buyers today are of the "Bank-Owned/REO Mentality." They want to buy something with that kind of price tag, regardless of who owns it. I came across an article from CNNMoney that really hits home on what is going on in the current housing market. If you want to sell a home in this market, no matter how much it hurts, you need to price your home like a bank-owned or REO property. That is your competition. The tough part about this is that bank-owned or REO properties are priced 20-40% less than the non-REO … [Read more...]